Employing a deliberate dual strategy involving the use of considered top down tactics combined with people-powered bottom-up mobilizing, campaigners, organizers and climate activists in Japan are slowly but surely moving the needle on what they see as the most effective way to accelerate climate justice: by going after the money.

350.org Japan along with a coalition of partner organizations have been fiercely organizing, mobilizing and campaigning for the country’s “Three Megabanks” – Mitsubishi UFJ, Mizuho FG and Sumitomo Mitsui to commit to phasing out financing for fossil fuels. As the world’s top three lenders to the coal industry, the institutions are under unprecedented pressure to set out clear plans to align with the goals set out in the Paris Agreement.

Under the Paris Agreement, countries agreed to take action to limit average global temperature rise to 1.5 degrees, a goal which will only be achieved by committing to net-zero emissions by 2050 at the latest, and halve global emissions by 2030.

Not only is climate change already bringing about disastrous effects for life on earth, it is increasingly acknowledged as a financial risk, as the imperative shift towards a carbon-free society becomes increasingly unavoidable. In this context, MUFG and Japanese megabanks are falling behind their competitors, and as such risk letting down their own investors.

This year, MUFG was the primary target of a coalition of NGOs who employed a variety of bottom-up and top-down tactics to achieve climate commitments from Japan’s largest financial institution. Beginning with a widely supported petition, fervent global actions complemented the momentum and set the stage for campaigners to make their case through the submission of a formal shareholder’s proposal to be tabled at the banks’ Annual General Meeting (AGM).

Co-filers of the shareholder proposal on June 29th, the day of the AGM. Image: RAN

Setting the stage from below

As part of an overarching finance campaign targeting Japan’s three megabanks, last year 350 Japan with the support of partner organizations submitted a petition calling on them to develop a fossil fuel phase-out strategy that aligned with the Paris Agreement, end loopholes that support the export of coal-fired power plants, and invest in energy-efficient, deforestation-free renewables. The petition was widely supported, garnering the signatures of 109 organizations and 2,470 individuals worldwide.

This year 350 Japan with a coalition of organizations including JACSES, Kiko Network, Friends of the Earth Japan, Mekong Watch, Greenpeace, and Rainforest Action Network circulated a second petition to the three megabanks. With the support of 143 organizations from 30 countries, calls to action included:

- A demand to cease funding of new fossil fuel related projects and projects that contribute to deforestation

- A demand for a concrete strategy that outlines plans, targets and metrics in the short, medium and long term to phase out existing investments and financing for fossil fuel related projects within a timeframe consistent with the Paris Agreement 1.5 degrees target.

- A demand to ensure a decarbonization roadmap that doesn’t rely on ‘unproven technologies’ – such as geoengineering, CCUS and co-combustion.

In the lead up to MUFG’s AGM, a series of global actions were staged to put further pressure on the bank. Between June 17-22, actions took place in Tokyo, Manila, Jakarta, New York, Amsterdam, Barcelona and Brazil — wrapping up a week before the June 29th AGM. The in-person actions were complemented by a digital effort using social media to spread awareness about the banks’ destructive practices. Hashtags like #DefundClimateChaos, #EndFossilFinance, and #DefundDeforestation made their rounds while petitions were submitted.

Action in Barcelona in solidarity with the finance campaign against MUFG in Japan. Image:

Interlude — clarifying points of contention

MUFG has publicly committed to align its business strategies with the Paris Agreement as a signatory to the UN Principles for Responsible Banking. However, achieving this alignment would require MUFG to adopt a commitment that required all projects and companies it supports are aligned with achieving the 1.5 degrees limit, commit to phase out financed emissions on a trajectory aligned with 1.5 degrees and accompanied by science-based targets, commit to end financing deforestation, and disclose its financed emissions as well as the processes and methodologies used to measure its financed emissions.

Rainforest Action Network (RAN) publishes an annual report on global banks’ fossil fuel financing. In 2020, the Banking on Climate Change report revealed that since the Paris Agreement, Japan’s three megabanks had poured $282 Billion into projects associated with fossil fuels. This year, the Banking on Climate Chaos report revealed an even more disturbing figure: the world’s 60 largest banks have funneled $3.8 trillion into fossil fuels since the 2015 climate agreement, and in the process, made over $16.6 billion in profits.

Headquartered in Tokyo, MUFG is one of the three ‘great houses’ of the Mitsubishi group, alongside Mitsubishi Heavy Industries and Mitsubishi Corporation. The world’s sixth largest fossil fuel banker, the 2021 Banking on Climate Chaos report identifies MUFG as the worst in Asia when it comes to fossil finance, contributing $148 billion to the industry since the Paris Agreement making it the world’s third largest lender to the coal industry.

Action outside MUFG in Japan on the day of the AGM. Image: Taishi Takahashi

While MUFG has committed to restrict financing of coal fired-power plants by 2040, there remain loopholes and exceptions that allow this support to continue. Its commitment regarding coal power plants is severely diluted by limits solely applicable to project finance, leaving out “significant amounts in corporate finance to coal plant developers”. In the three years between 2016 and 2019, the bank engaged in lending and underwriting to the tune of US$536 million to the world’s top 30 coal mining companies, and US$5.048 billion in finance for the world’s top 30 coal power companies. One project it has pledging funds to — along with Mizuho and SMBC — is the Vung Ang 2 mega coal plant currently under construction in Vietnam, a 1.2 GW plant which in addition to grave environmental and human rights concerns is recognized as a ‘financial disaster’ posing a negative profitability of US $158 million.

Demonstrations as part of the global day of action against MUFG in Jakarta, Indonesia. Image: Reno Yunanto

The bank is also a large contributor to global financing of arctic oil and gas, fracking, tar sands production and pipeline development. It backs Enbridge’s ‘Line 3’ — a tar sands pipeline proposal that would carry 750,000 barrels of oil per day from Alberta, Canada to Wisconsin, in the United States directly through indigenous wetlands belonging to the Anishinaabe peoples in Minnesota. The carbon emissions that would result from this project are estimated to be equivalent to 50 new coal plants every year. In recent weeks, peaceful yet firm opposition to the pipeline from indigenous-led activists, water protectors and other allies attempting to block construction efforts have been met by Enbridge-funded police intimidation tactics described as a ‘corporate counterinsurgency’.

MUFG is also involved in a loan valued at US $1.3 billion to Bhimasena Power Indonesia, which is developing a 2,000 MW coal-fired power plant in the town of Batang in Central Java. This power plant is predicted to cause 30,000 premature deaths over the course of its lifetime — 40 years — and would be responsible for the release of 10.8 million tons of carbon emissions.

While in 2019, MUFG added forestry and palm oil sector policies to its Environmental and Social Policy Framework, these rely on weak certification measures. One of the largest financiers of Conflict Palm Oil — the leading cause of deforestation in Southeast Asia, affecting ancient rainforests and peatlands with serious destructive impacts on rainforests, human rights violations, climate change and biodiversity loss — the bank provided over $1.2 billion in loans and underwriting to the industry between 2016 and 2019, primarily in Indonesia. This sees Indonesia remain one of the world’s leading emitters of greenhouse gases, as land use emissions remain the leading cause of Indonesia’s total emissions.

In addition, the industry has been a major contributor to Indonesia’s devastating forest fires, which have been found to be instigated by companies using fire as a method of clearing rainforests and carbon-rich peatlands. In Aceh, the community of Pante Cermin have experienced the use of military backed land grabs and violent suppression of opposition to palm oil development. MUFG’s subsidiary in Indonesia, Bank Danamon, is excluded from MUFG’s financing policies and is not limited by any policies restricting its involvement with the financing of palm oil in Indonesia.

Coming in with unprecedented action from above

In addition to people-powered methods involving the petition and global mobilizations in support, the central and arguably most strategic tactic of the finance campaign as a whole revolves around the submission of resolutions to Japan’s three major banks as shareholders, ensuring meaningful dialogue with investors in the lead up to and during the institutions’ AGMs. The strategy is a seasonal one — aligned with the yearly AGM season, which occurs in June each year, where shareholders and investors convene to make decisions.

In 2020, Japanese NGO Kiko Network filed Japan’s first ever climate resolution on a Japanese financial institution with Mizuho Financial Group. At Mizuho FG’s AGM that year, which was attended by members of Fridays For Future Japan, RAN and other environmental groups, the proposal garnered the support of 34.52% of shareholders. While this fell short of the two thirds required for approval and the establishment of a concrete policy, the result — which was also supported by investors’ two major proxy advisors — was regarded as a huge success and demonstrated a growing sentiment among investors towards climate mitigation.

This year, a similar tactic was set in motion with MUFG as the main target. On March 26th, co-filers including Kiko Network and individual shareholders affiliated in 350 Japan, Rainforest Action Network and Market Forces with full organizational support filed a climate resolution to Mitsubishi UFJ Financial Group — the first of its kind the bank has been met with — in an effort to inform investors of the climate risk associated with the bank’s activities in financing and investing in fossil fuels and contributing to global deforestation.

It called on MUFG to adopt and disclose a plan that would align its investments and financing with targets set out in the Paris Climate Agreement by establishing a strategy including short, medium and long term targets, arguing that failure to do so would pose a financial and reputational risk to the company.

The specific ask of the shareholder proposal was for MUFG to make a partial amendment to the banks’ Articles of Incorporation, which as the proposal states, is the only legal pathway for a shareholder proposal on climate change in Japan by adding the following clause:

“The company shall adopt and disclose in its annual reporting a plan outlining its business strategy, including metrics and short-, medium- and long-term targets, to align its financing and investments with the goals of the Paris Agreement”.

It was accompanied by an explanatory briefing for investors which, in non-adversarial language, expressed the aim of maintaining the bank’s corporate value through ensuring that investors make investment decisions according to a proper understanding and evaluation of the climate risk of MUFG’s financing and investments.

“This shareholder proposal is not intended to be unduly prescriptive… we believe the proposal grants MUFG the flexibility to realize the proposal’s aims while taking into account client relationships and corporate interests.”

Two months later on May 17th, MUFG published its “MUFG Carbon Neutrality Declaration” which included a commitment to achieve net zero financed emissions by 2050 and join the Net Zero Banking Alliance. It was the third announcement MUFG had released relating to its climate approach since the proposal was filed, following the “Establishment of the MUFG Way and new Medium-term Business Plan” and the “Revision of the MUFG Environmental and Social Policy Framework” in April.

Eri Watanabe, 350 Japan’s Finance Campaigner believes the Carbon Neutrality Declaration in particular wouldn’t have occurred without pressure from the sustained multi-partner campaign against the institution: “Without our proposal, this wouldn’t have happened” Watanabe said. “That’s an achievement which would have ripple effects on other megabanks”.

While the publication of the declaration was welcome and made MUFG the first Japanese bank to commit to a goal of net-zero emissions by 2050, it did not set out clear targets for the short and medium term realization of these goals, instead stating it “will work to set and disclose an interim milestone for 2030 in FY2022”. Furthermore, it did not commit to phase out the expansion of oil and gas or support for projects that contribute to deforestation.

Co-filers on June 1st released a second explanatory briefing outlining concerns about the inadequacy of the declaration for investors to consider prior to the bank’s AGM on June 29th.

Departing from the previous year’s proposal targeting Mizuho FG, this year, both proxy advisors involved — Institutional Shareholder Services (ISS) and Glass Lewis — recommended investors voted against the proposal. This time of year is recognized by advisory firm Glass Lewis — one of the proxy advisors involved in MUFG’s 2021 AGM — as ‘Japan’s proxy season’, described by the firm as “one of the biggest challenges for investors”.

In response to these recommendations, in a final push in response, co-filers released a third investor briefing on June 22nd, a week before the AGM.

“We thought we needed to explain to the investors that the advisors’ analysis was not appropriate and incorrect in some aspects, we wanted to convince the investors that they needed to make their own decisions,” Watanabe said.

Takayoshi Yokoyama of 350 Japan following MUFG’s AGM, June 29th. Image: 350 Japan

An achievement not to be dismissed

Ultimately, the shareholder proposal received 23% support from investors at the AGM in Tokyo. 350’s Japan’s team leader, Takayoshi Yokoyama believes the recommendation to vote against the proposal was partially responsible for the discrepancy between last year’s 34.5% of investor support at Mizuho and this year’s 23% at MUFG.

“There are two main reasons for this I believe: the first one is, the two proxy advisors – ISS and Glass Lewis – who last year recommended investors at Mizuho support us, this year recommended investors at MUFG oppose the resolution. We’re suspicious about what happened.

Secondly, MUFG belongs to the Mitsubishi conglomerate — and their regulations are the tightest in Japan. It must be a very stable and solid group of shareholders who voted against us”.

Kiko Network reported that at the AGM, ISS had alluded to MUFG’s neutrality declaration as an indication that the efforts of cofilers had already beared fruit, and an MUFG spokesperson later confirmed to Reuters the resolution was opposed on the basis that its ‘essential content’ had been addressed in the Carbon Neutrality Declaration.

In evaluating the result, 350 Japan’s Yoyoyama said “while MUFG’s new policy has temporarily assured some investors the bank is on the right track, today’s vote shows a high level of dissatisfaction and concern”.

“Given that the proxy advisors recommended the investors vote against our proposal, the 23% support it got was quite significant. I think our proposal must have been very meaningful to send a message to MUFG that they need to go much further” added Watanabe.

The coalition of co-filers at a press conference following MUFG’s AGM. Image: 350 Japan

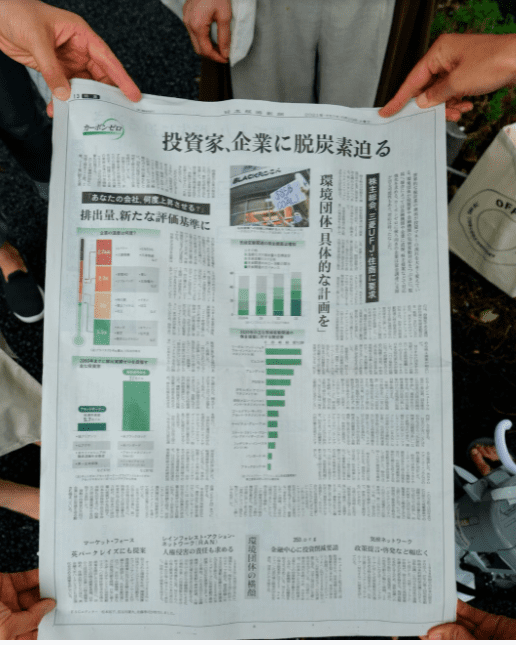

While outsiders described the result as evidence of a failed tactic — citing a similar result regarding a resolution recently proposed at Sumitomo — prominent financial newspaper The Nikkei dedicated an entire page to covering the story in favor of the climate proposal. This marked a significant win for co-filers and indicated that support for climate-friendly finance is growing within the business community.

A full page spread in The Nikkei on the finance campaign against MUFG. Image: Taishi Takahashi

Planning for next year’s strategy on Japan’s three megabanks will soon be underway. 350 Japan’s Watanabe and Yokoyama both stated support for continuing with the tactic of engaging with investors as shareholders, while expressing that increased public pressure and momentum from below would be welcome and undoubtedly strengthen the campaign.

“Banks are concerned about reputational risk. If there is action in front of those banks, they hate it. So it is very important to stimulate concerns about their reputation” Yokoyama said.

“In addition to investor pressure, we need to put more public pressure on them — 350 believes in people power and we mobilize, organize, and bring together people power. We need this to continue and grow. It needs to be a combination of putting pressure from shareholders or investors but also from the public” said Watanabe.

On the joint effort between the coalition of co-filers, she added — “this collaborative work has been really powerful”.

While the result this year was insufficient to pass the shareholder resolution, dismissing it fails to capture the unprecedented nature of commitment and acceleration of climate related pressure that the campaign has set in motion for financial institutions in Japan. As momentum continues to gather, more firsts are undoubtedly on the horizon.

People power in support of the finance campaign in Japan on June 29th, 2021. Image: 350 Japan