It’s simple — to prevent devastating climate breakdown, we have to end all finance to fossil fuels.

This motto will continue to guide our campaigns, organising and mobilisations at 350.org in the coming year. Our global community is coming together to fight for climate justice, by going after the money that funds the big polluters’ dirty coal, oil and gas business.

No money to fossil fuels means no new dirty projects, less pollution, and a real chance to prevent further climate disasters. It also means a real opportunity to do things differently and invest instead in a liveable future, a real green new deal for all, and a just recovery from the pandemic.

10 days ago, on the fifth anniversary of the Paris Climate Agreement, around two and a half thousand of 350.org Europe supporters took part in a short online survey, to help our movement get the input we need to plan impactful campaigns against fossil finance for 2021.

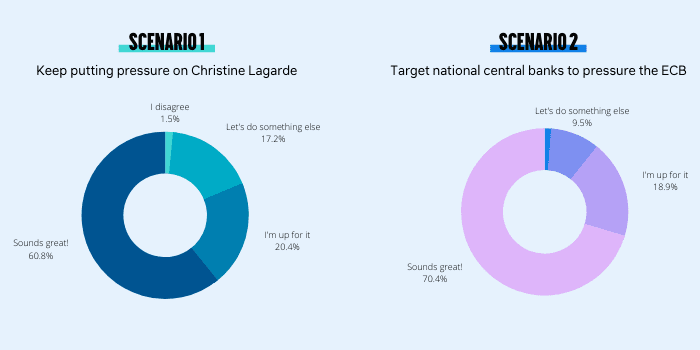

We asked people across Europe to respond to four scenarios, representing four possible approaches to our flagship campaign to get Europe’s rich and powerful central banks out of fossil fuels for good.

The scenarios, in brief, were:

- We continue to target the European Central Bank, and specifically its President Christine Lagarde, demanding that they end their support to fossil fuels;

- We pressure national central bankers across the Eurozone (like Bundesbank or Banque de France) to steer the European Central Bank away from fossil finance;

- We focus on a small number of worst-in-class European fossil fuel companies and their dirty projects, and go after their main public financial backers, to change public opinion;

- We continue to target Europe’s central banks and focus on demanding a green and just recovery to address the climate crisis and the impacts of the Covid-19 pandemic.

The results of the survey are heartening. Overall, our community shows strong support for our general 2021 direction of travel: disrupting and ending fossil finance, in Europe and across the world.

Graphs showing the results of the survey about possible approaches to fossil finance campaigning at 350.org Europe

2020 has been a really difficult year for many of us. We’ve struggled through a pandemic, an economic crisis, and devastating climate impacts. It’s not surprising to see that over 80% of us are fully on board with continuing our fight for a green and just recovery in 2021. It’s clear that we cannot afford to spend Covid-19 recovery money on a business-as-usual that will plunge us deeper into the climate crisis. Instead we need to pressure the most powerful banks in the world to aim to solve two crises at a time.

We all know — and we see from the results of the survey — that central banks aren’t the most exciting campaign targets. The work of these huge bureaucratic institutions often happens behind the scenes, in a cocoon of expert jargon. Many of us don’t know much about what central banks do.

We chose the European Central Bank as our target precisely because of its immense power. The ECB, more than any other financial institution in Europe, could genuinely shift the way the world views fossil finance.

We still have a way to go to paint a compelling picture of how applying people power to central banks can help us solve not only the climate crisis, but also stop the environmental and human rights abuses of European oil and gas companies in Africa and Latin America.

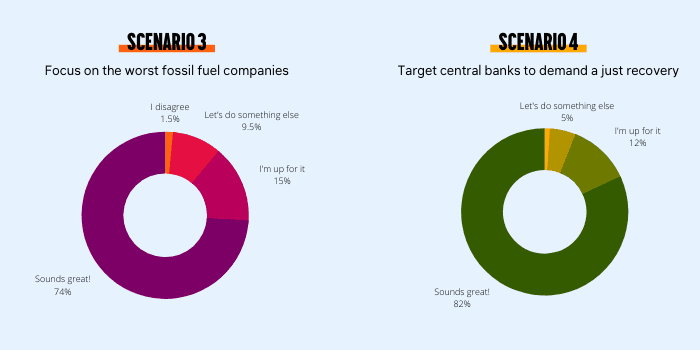

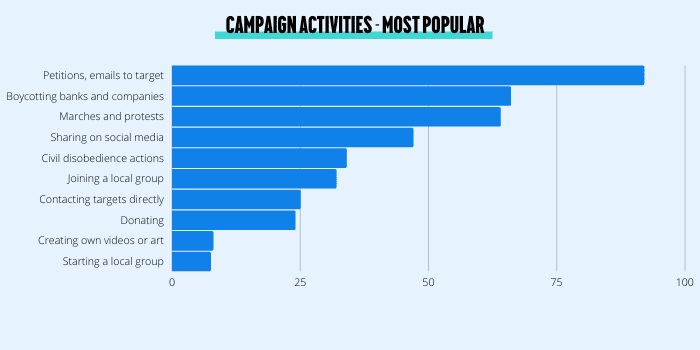

The good news is, there’s a lot of energy among our European supporters to get on with it. In the survey, we asked which campaign activities people would like to get involved with in the coming year. As soon as we can, and when it’s safe to do so, we’re excited to try any and all of these!

Graph showing the results of the survey, question: which of the possible campaign activities would you like to get involved with?

It’s great to see that an overwhelming number of us are still interested and ready to take action online, even after the year we all spent adjusting to campaigning and organising in digital spaces.

Online tools and channels such as petitions, social media sharing and storytelling give our campaigns scale, and make them accessible to an even broader audience, allowing us to put more pressure on our targets. In 2021 there will be many opportunities to take action online against fossil finance. One exciting online event is coming up soon: in spring we’re going to bring together groups, artists, activists and supporters in a massive movement event for a just recovery. Just stay tuned — invites are coming soon.

It’s also exciting to see how many of us are ready to go offline and out on the streets again to take action. Over 60% of us are up for joining a march or protest in 2021, and the same percentage would be willing to boycott banks and companies that finance fossil fuels.

Hold on to that enthusiasm for offline protests, because in Autumn 2021 (public health situation permitting) we’re joining forces with colleagues and movements across the world to mobilise for a global wave of action against fossil finance. Plans are underway!

One surprising – but also exciting – thing we learned from the survey results is that a third of us are willing to carry out civil disobedience to stand up to planet-wrecking fossil fuel companies and the banks that finance them. Nice. We’ll get back to you on that one 👀

Finally: if you took the time to share your thoughts in the survey, thank you! What we learned is going to help inform our plans for the coming years, and make sure we’re picking the right battles to fight together.

Learn how we End Fossil Finance in Europe

If you’re new to campaigning against fossil finance and the power of the coal, oil and gas industry, or just want to learn more and feel inspired, we’ve relaunched our End Fossil Finance campaign website – so go and have a read!