On December 4th, the Obama Administration announced that it will not grant Energy Transfer Partners the final permit for the Dakota Access Pipeline to drill under the Missouri River, and called for an Environmental Impact Statement (EIS) on the project. This milestone is a testament to the amazing movement that indigenous leadership and the camps at Standing Rock have led, and has re-defined what is possible when thousands of people come together to peacefully resist.

But the fight to stop Dakota Access isn’t over — and right now, before Trump comes into office, is a critical moment.

We can’t say for certain what will happen when Trump’s in office, and we don’t know how an attempt to reverse this decision will play out in the courts – so right now it’s crucial that we use another source of our strength to stop this project: our financial power and collective pressure.

The divestment movement has already shown the power of moving our money and rejecting the social license of the fossil fuel industry. Just this week, it was announced that total assets committed to divest surpass $5 trillion. Now we need to turn that power and momentum to Dakota Access.

The Dakota Access pipeline is being financed in various ways by 17 banks (here’s a list with contact info for each). Thanks to the enormous pressure on the banks through direct action, letters, and people withdrawing their money, they’re showing signs that they’re re-considering their investments.

And that’s especially important, because on January 1st of the new year, oil companies with contracts to ship oil through the pipeline will be able to renegotiate or cancel those contracts. The more banks that waver on funding this project, the more likely that fossil fuel companies will see Dakota Access as an unviable option for bringing their products to market. Without crude oil to transport, Dakota Access becomes financially unprofitable and moot.

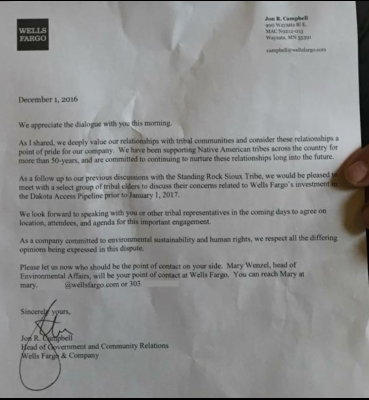

Wells Fargo agrees to meet with Tribal Elders following public pressure and people closing their accounts

We’re already tipping the scale. Seattle recently cut ties with Wells Fargo because of their irresponsible investment in the Dakota Access pipeline, and cities like Minneapolis are also taking steps toward similar action. One of the major Norwegian banks has already pulled funding from the project because of the pressure applied by the Sami people in Norway, and the growing global opposition to this project and fossil fuel infrastructure writ large.

Throughout December organizers at Standing Rock have called for a global month of action to target the banks and divest from the Dakota Access pipeline. Through shifting investments and putting pressure on lending banks, we can put a permanent stop to this pipeline.

To join the December month of action, check out the following links:

- Divest. Our friends at Yes! Magazine have put together a great list for how to make the biggest impact when you divest from Dakota Access. Write a letter, defund your assets, find a better bank, measure your impact, and share your story with #DeFundDAPL.

- Get in the streets. The financial footing of the Dakota Access Pipeline is in jeopardy. Join or plan an action near you calling on the banks to pull their funding for the Dakota Access Pipeline.

- Add your numbers. Help the movement track and measure its impact by adding your divestment commitment to defunddapl.org. So far #DefundDAPL has exceeded $21 million already!

Why your action matters now

While each of the companies involved hold lines of credit with numerous banks and financial institutions, the money that is earmarked specifically for the project is a $2.5 billion project finance loan.

This project loan was coordinated by Citibank, the Bank of Tokyo-Mitsubishi, Mizuho Bank and TD Securities. As per the terms of the loan, Dakota Access could only access $1.1 billion immediately — the other $1.4 billion would not become available until the pipeline received the appropriate permits.

If Citibank, TD Securities, the Bank of Tokyo-Mitsubishi, and Mizuho Bank were to hold back the remaining $1.4 billion, the cash for the pipeline could dry up and the project could come grinding to a potentially permanent halt.

Our friends at 350.org Japan and Greenpeace held a demonstration in Tokyo after sending this letter demanding that Japan’s major banks—including Bank of Tokyo-Mitsubishi and Mizuho Bank—immediately divest from the project.

Our friends at 350.org Japan and Greenpeace held a demonstration in Tokyo after sending this letter demanding that Japan’s major banks—including Bank of Tokyo-Mitsubishi and Mizuho Bank—immediately divest from the project.

The other two major banks, Citibank and TD Bank, have a large presence in North America. Their customers need to know what these banks are supporting and their executives should be warned that we’ll disrupt business as usual until they withdraw their funds for the project.

That’s why your help to #DefundDAPL is more important than ever.

P.S. Want to get even more involved in the divestment movement? You may have a relationship to an institution such as your university, pension fund, or faith group that has yet to divest from fossil fuels. Now is the time to push them to divest from Dakota Access and all fossil fuel companies. If your institution has already divested, write them to ensure their investments in DAPL were amongst those shedded. If yes, express your appreciation and encourage them to make it public and track their action at defunddapl.org.