Facing an economic crisis, Russian authorities are giving unprecedented tax subsidies to the fossil fuel industry that lead to new drilling in the Arctic and East Siberia. Will ‘climate denialism’ benefit the Russian economy?

The recent call by the Russian Deputy Prime-Minister Siluanov to “tighten belts” has convinced even optimists that something is deeply wrong with the Russian economy. Undeniably, the planned increase in taxes (introduction of sales tax, rising VAT and income tax rates) will inflict severe damage to most businesses and their employees. A recent example highlights this issue, where 650,000 entrepreneurs were forced to close their business in the wake of a tax increase for individual entrepreneurs in 2013. There are, however, some who luck out and will not only escape the “belt tightening”, but are about to enjoy tax havens. They are not farmers, high-tech, or education & science professionals, but Russian and international oil giants involved in oil and gas projects in the Arctic and Eastern Siberia.

“In October, Vladimir Putin signed a bill according to which extraction of oil at sea deposits will be exempted from severance tax. Moreover, sales, transportation, and utilization of the oil extracted from the sea shelf will be freed from VAT” – highlights the “Rossiiskie Nedra” (Russian Subsoil) newspaper.

Some continental oil projects were also endorsed by the “Tsar’s Generosity” :

“For four Russian deposites with “tough oil” [shale oil, etc.] – Bazhenovskaya and Abalakskaya (Eastern Siberia), Khadumskaya at Caucasus, and Domanikovaya at Ural –severance tax rates were zeroed. Other deposits got severance tax preferences from 20 to 80%” – source

In fact, the Russian officials’ attitude responsible for the tax policy is very simple. In light of the crisis that faces the oil&gas dependent economy (half of the state budget, 2/3 of the export come from the fossil fuel industry), Russian officials follow common patterns, stimulating more drilling, and charging the rest of the economy with the additional tax burden.

There are many cautionary tales from renowned economists about the “resource curse” and its consequences for countries affected, ranging from weak industries and agriculture to dictatorship and corruption. Economists, however, have insisted on differentiating between economic and social impacts of fossil fuel dependency, and its repercussions on the environment and climate. Social, economic and environmental repercussions, however, are intricately linked, and Russia might be one of the first to experience their impact in the nearest future.

Mr. Siluanov’s position suggests a lack of familiarity with Humphreys or Guriev. But he should nonetheless be aware of the official position of the UN Climate Convention voiced by its Executive Secretary Christiana Figueres that outlines the need for ¾ of known oil deposits to remain underground to avoid the worst climate scenario. We would hope this level of understanding of an official representing Russia as a country-member in the UN Security Council. Coincidentally, the Russian delegation will attend the UN climate summit in September soon. Will it be prepared to explain why instead of limiting fossil fuel extraction, economic and tax policy is now aimed at stimulating as much drilling as possible?

Not only the UN warns of high climate risks due to burning of fossil fuels. In 2005, Russia’s own meteorology service Rosgidromet issued its prognosis of climate change and its consequences for Russia. It foresees that the pace of climate change in Russia is two times faster than the average of the world, as indicated in my recent article. It results in an increase in both frequency and strength of the “extreme climate events” – including floods, hurricanes, droughts, wildlife fires – so strong that the number of such events almost doubled during the last 15 years .

Unfortunately, these extreme climate events do not only result economic damage, but they also affect people, as evidenced in the extreme weather in Russia in July that did not even involve any extraordinary natural disasters like floods in Altai, Khabarovsk, Krymsk, or forest fires around Moscow in 2010:

“Following Sverdlovsk and Chelyabinsk District where snow fell during last weekend, a natural anomaly occurred in Novosibirsk, and brought few casualities” , “Two twin sisters, aged 3, died under a fallen tree during the strong wind in the town of Berdsk, Novosibirsk District”. – znak.com, July 14

“The flood in Yakutia lasts a week, and inflicted submersion of Ozhulun Village of Churapchinsky District last Saturday. Due to the rise of Tatta river, 57 houses were drowned” – newizv.ru, July 14

“Flooding in Tuapse [Black Sea cost] occurred on July 8, 2014… has actually left 236 citizen homeless”.

How many climate disasters need to occur to make Russian officials believe that climatologists are not lying?

They are most likely not to take climatologists warnings’ or climate disasters seriously. Often, the disasters in Russia become the problem of the victims themselves, or, in the best case scenario, of volunteers. Official compensations to the victims of the Altai flood, for example, still range around RUR 10000 (~$300) per person (source , – promised more, but “no funds currently available”). Ignoring climate related problems does not address them, however.

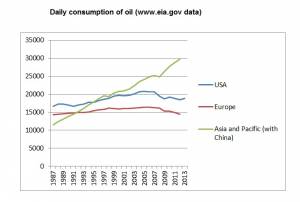

In our case, the big problem for Russia may occur even if the “clients” of the oil industry take UN climate warnings seriously. For example, the European Union (still the main consumer of Russian oil&gas) has announced its ambitious “20/20/20 program” – increasing renewable share up to 20%, energy efficiency by 20%, and decreasing carbon emissions by 20%. The United States has decided to decrease carbon emissions from power plants by 30%. These are only the first steps to decreasing fossil fuel consumption , which has almost not increased in the US and EU in the last 5 years.

One can see that China and South-East Asia have become the major drivers of the still rising demand for oil. This fact has likely inspired Putin’s recent “turn to the East” much more than the recent “sanctions”.

But there are serious doubts that Asia’s greed for oil would last long. Recently, China admitted that it will take steps to limit carbon emissions soon – first time in history. China has already turned to “green energy” – taking first place in the world in investments into renewables

Will other Asian countries follow? Perhaps, yes – because they have strong motivation. According to Erin McCarthy from the Wall Street Journal, Asia’s loss due to global warming may be huge, and can reach 6% of GDP by 2060 in spite of the measures taken to curb emissions.

What does this mean for Russia?

If the “client” countries will meet the carbon emission targets, one can expect a decrease in oil demand over the next ten years by at least 10-20 %. A decrease of demand usually leads to falling prices, albeit not proportionally. At times, especially when the market is “overheated”, a small decrease in demand can trigger an “explosive” drop in prices. Economists call such a situation “a bursting bubble”. The 1998 crisis was triggered by such a bubble in the South-East Asia real estate market.

Today, the situation in oil (and, generally, the fossil fuel) market is often called “a carbon bubble”. The high oil prices stimulate investments into oil drilling in the hope for a stable and long-time income. Once the world takes climate issues into account, however, and realizes the need to leave most of the oil in the ground as recommended – the oil assets go down in value. The investors consequently try to withdraw their money from the fossil fuel sector. Facing crisis, oil companies will be forced to decrease production and prices.

According to Professor of Mineralogy Dr. Viktor Gavrilov, the price of Arctic oil (incl. transportation) is about $ 700 for a ton. It is about $90 for a barrel – i.e., very close to the present market price $100 – 110. In comparison, during the 1998 crisis, the cost was only $ 11 for a barrel. This means that if the “carbon bubble” bursts Russia will end up with its sustainable businesses restricted by its own tax policies, and a perfect network of shelf platforms, oil rigs, and pipelines rendered completely unprofitable and useless.

The fossil fuel industry makes up the core of the Russian economy. Russia risks to affect the climate, and ruin its own economy. Russia is engaging in a losing game: if the leading energy consumers are unable to decrease oil consumption – the climate will be ruined everywhere including Russia, and if they manage to start turning away from the fossil fuel dependency – the Russian economy will be affected disproportionately. Not a pleasant future for Russia, especially if we take into consideration the likelihood of major disasters like the Mexican Gulf in the Arctic, and countless minor leaks along all the Russian pipelines.

Does Russia have any alternatives to the fossil fuel economy? It is worth recalling one of the recent articles in Russian Forbes

Its author, a Russian financier, has convincingly shown the “Achilles’s heel” of the modern Russian economy, which consists of extremely underdeveloped small and medium businesses, and the current tax plans promise make them extinct completely. If Russia is able to reverse this policy, and give small business greater prominence in the economy that it plays in the US or Europe, it could spur growth comparable to that expected from oil and gas, in the absence of the detrimental “side effects” of the fossil fuel economy. This scenario as idealistic it may seem, can become reality by diminishing the influence of the “big oil” lobby in the government and trying to re-build the taxation system profiting the majority of Russian citizens, not the minority of the oil industry.