In a sign that fossil fuel companies, are stooping to new lows, an investigative report published in the most recent edition of Bloomberg Businessweek revealed that PR firms have set up fake anti-divestment, pensioners’ rights groups to lobby against divestment. We are already knew that oil and gas companies like Exxon have for decades lead campaigns to hinder climate action and sow confusion about the science of climate change. This most recent expose, months in the making, reveals that fossil fuel companies are scared of the success of the global divestment movement, and pulling out all the sneaky and nefarious stops to trying to erase the fossil free writing on the wall.

One such group – Protect our Pensions – has published opinion pieces in newspapers and written letters to legislators and pension trustees, supposedly from regular “Jane and Joe” pensioners. Turns out though, most of these pieces have been written by public affairs firms “operating in the shadows” according to Bloomberg.

The use of the tactic of creating fake groups, also known as astro-turfing groups, to counter the campaigns of real grassroots groups fighting to save our planet is growing as fossil fuel companies including pipeline builders find their projects repeatedly delayed or cancelled. The desperation is revealing and is a clear validation that our campaigns have traction and are affecting change.

The use of the tactic of creating fake groups, also known as astro-turfing groups, to counter the campaigns of real grassroots groups fighting to save our planet is growing as fossil fuel companies including pipeline builders find their projects repeatedly delayed or cancelled. The desperation is revealing and is a clear validation that our campaigns have traction and are affecting change.

As further proof of the success of the global divestment movement and in the midst of COP23, the United Nations Secretary General said that investing in fossil fuel projects mean an “unsustainable future”, one that we must avoid at all costs. António Guterres called for “more ambition, more leadership and more partnerships to tackle climate change.”

The world should adopt a simple rule: If big infrastructure projects aren’t green, they shouldn’t be given the green light. Otherwise we will be locked into bad choices for decades to come. Investing in climate-friendly development is where the smart money is needed” – United Nations Secretary-General António Guterres

His words seemingly foreshadowed an announcement, described as “heard around the world”, by the Norwegian Sovereign Wealth Fund, that is is proposing to divest from oil and gas companies. The fund, valued at more than $1 trillion and the largest fund in the world, currently invests more than $35 billion in oil and gas companies like Exxon, Chevron, Shell and Total.

“Our perspective here is to spread the risks for the state’s wealth,” Egil Matsen, the deputy central bank governor overseeing the fund, said in an interview in Oslo. “We can do that better by not adding oil-price risk.”

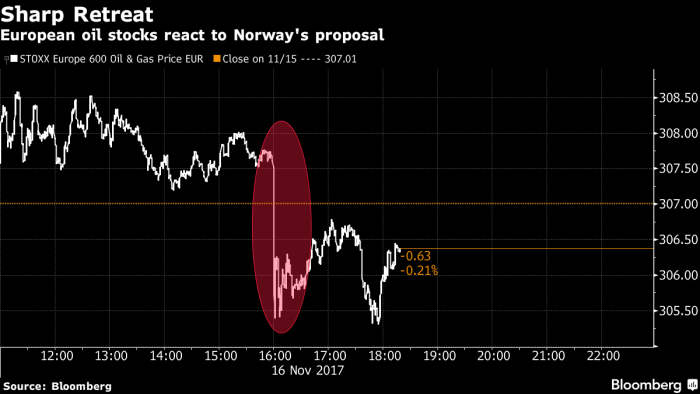

According to Bloomberg, “the fund, which controls about 1.5 percent of global stocks, said it doesn’t expect returns or market risk to be affected “appreciably” by its proposal, emphasizing that cutting exposure to the energy industry would allow it to crank up investments in other sectors”. After the announcement stocks of large oil and gas companies plunged.

Bloomberg: Oil and Gas stocks drop after Norway signals divestment

One could easily argue that if this fund, built on oil and gas royalties, can in a financially responsible fashion, divest from fossil fuels then any pension fund or university endowment could do the same. And that would include iconic pension funds like New York City’s valued at $160 billion.

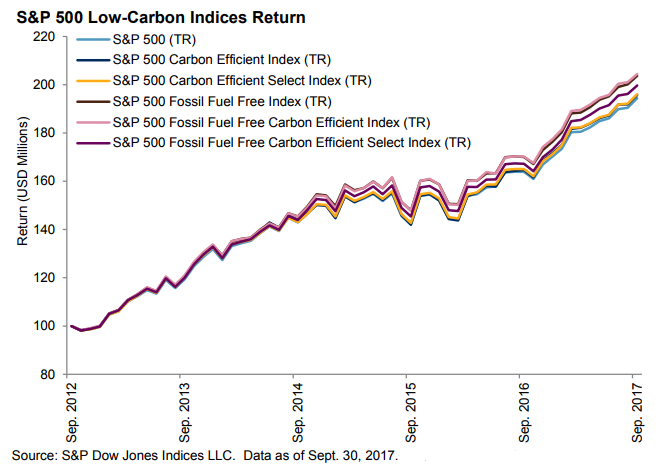

Meanwhile the very mainstream and financially conservative S&P Global showed that fossil free investments outperformed regular indexed investments over the past 5 years. Further proof that divestment from fossil fuels is not only the morally correct thing to do, it is a financially prudent action as well.

S&P Dow Jones – Fossil Free indices outperform

Join us as we take action the stop all fossil fuel projects and move to 100% renewable energy.