The New York State Common Retirement Fund (Fund) has lost more than $850 million on just 18 oil and gas stocks over the last year as the energy sector faces increasing volatility and declining prospects, according to new analysis by 350.org. New York State Comptroller Thomas DiNapoli, the sole custodian of the Fund, has so far refused to divest from fossil fuels.

The Fund serves as the retirement fund for more than 1 million New Yorkers and its oil and gas holdings have left it overexposed to the precipitous drop in energy stocks over the last week.

While government stimulus may trigger a slight rebound in the coming days, most analysts agree the overall outlook for the sector is dim. CNBC’s Jim Cramer has gone so far as to talk about the “death knell” of the entire industry.

350.org’s preliminary analysis looked at the Fund’s publicly disclosed oil and gas holdings focusing on its significant tar sands holdings and top fracking companies. It is reasonable to assume that the damage is far more widespread across the Fund’s full fossil fuel holdings and the Fund is likely down billions of dollars across the entire fossil fuel sector this year.

Oil majors in the New York State’s pension fund’s holdings are ⬇️:https://t.co/mDUH6NbuG9 analysis shows the state fund’s losses on fossil fuels of over $850 mil this year. https://t.co/oyXAw5F5jX #DivestNY

Conoco -25% ⬇️

BP -19% ⬇️

Shell -18% ⬇️

Chevron -15% ⬇️

Exxon -12%. ⬇️ pic.twitter.com/mIk8ly2Ab9— 350 dot org (@350) March 12, 2020

The Fund has more than $13 billion invested in fossil fuel companies. Many oil majors in its holdings were down double digits this week.

The value of the fund’s holdings in ExxonMobil, a company the New York State Attorney General sued for allegedly misleading its shareholders about the risks of climate change, has dropped by more than $400 million since March 2019.

The Fund has more than $2.5 billion invested in just 11 tar sands majors and these are all down double digits as well, with their total value dropping by over $860 million in the past year. If the price of oil stays low, many of these companies face increased risks and potentially bankruptcy.

CEOs of oil companies are calling it a “bloodbath”. Financial Post, 9 March 2020

Major US gas fracking companies such as Apache, Chesapeake, Devon and Noble are all down 30-55%. NYSCRF’s investment in Apache, valued at $62 million a year ago, is now worth less than $17 million. The company dropped by 54% just on Monday.

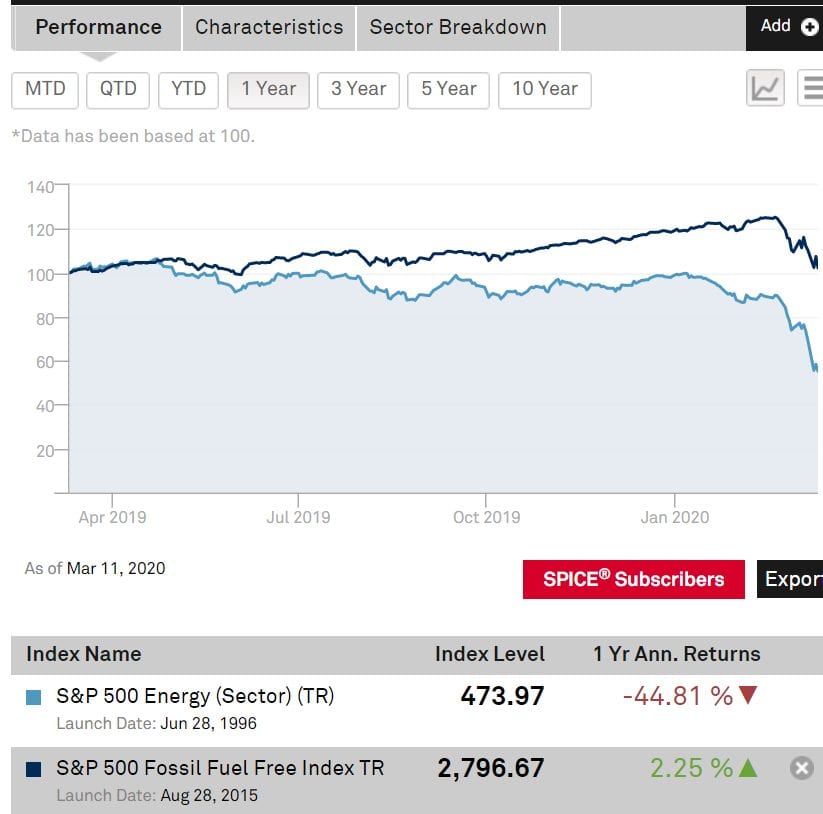

The collapse of the Fund’s oil and gas holdings isn’t surprising given the sector’s overall poor performance. Last year, S&P 500 Energy companies were down 44% while the rest of the S&P 500 rose by 2%. That’s a 46% difference in performance.

A performance comparison between S&P 500 Energy Companies and the rest of the S&P 500 over the last year is revealing:

1 year performance of S&P 500 Energy companies vs all other S&P 500 companies.

Divest now

For years, fossil fuel divestment advocates have warned Comptroller DiNapoli about the financial as well as climate risks of continuing to invest in oil, gas, and coal companies. A 2018 study by Corporate Knights concluded that the Fund would be an estimated $22.2 billion richer if it had decided to divest its fossil fuel stocks ten years ago. Since that study has been released, pension fund holders have missed out on hundreds of millions of dollars more of potential gains because of Comptroller DiNapoli’s refusal to change course.

These numbers help explain why the Fossil Fuel Divestment Act in the New York State legislature has gained such momentum in recent weeks. The act now has 31 Senate supporters, one away from a majority, and 45 Assembly Member supporters. It is unclear if the act will go to a vote this session, but the message from the legislature to Comptroller DiNapoli is already clear: you need to act now in order to protect the climate and New York state pension holders.

Press release, 12 march 2020