- Commercial banks providing more money to the coal industry since the Paris Agreement

- Japanese banks are top lenders, while China, Japan and India account for 70% of underwriting to coal companies

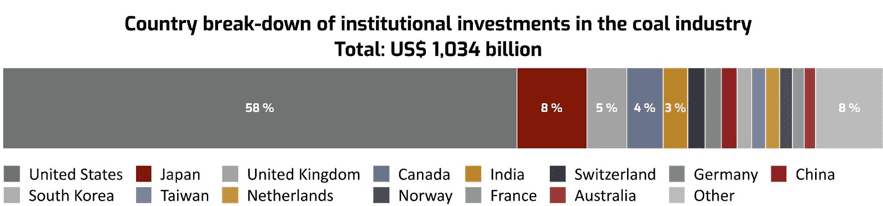

- US investors hold 58% of institutional investments in the coal industry, with Japan in second place

Global — Today, Urgewald and a group of more than 25 civil society organizations, including Reclaim Finance, Rainforest Action Network, and 350.org, published groundbreaking research on the financiers and investors behind the global coal industry.

The Global Coal Exit List (GCEL) shows that, by January 2021, 4,478 institutional investors held investments totaling US$ 1.03 trillion in companies operating along the thermal coal value chain world wide. Among the investors covered by the research are pension funds, mutual funds, asset managers, insurance companies, commercial banks, sovereign wealth funds and other types of institutional investors.

“In past years, the scope of our financial research was limited to around 200 coal plant developers. Our new research, however, analyzes financial flows to all 934 companies on the Global Coal Exit List (GCEL). This is the first time anyone has attempted to analyze commercial banks’ and institutional investors’ exposure to the entire coal industry,” says Katrin Ganswindt, head of financial research at Urgewald.

Top Institutional Investors in the Coal Industry

The world’s largest institutional investor in the coal industry is the US mutual fund company Vanguard, with holdings of almost US$ 86 billion. It is closely followed by BlackRock, which holds investments of over US$ 84 billion. Together, these two investment giants account for 17% of institutional investments in the global coal industry.

Based on their size, BlackRock and Vanguard’s coal investments are in a class of their own, but they are also representative of a much bigger problem. US investors are the single largest provider of institutional investment to companies on the Global Coal Exit List. With shares and bonds in value of US$ 604 billion, US investors collectively account for 59% of institutional investments in the global coal industry.

With holdings of US$ 81 billion, investors from Japan account for the second highest share of institutional investments in the coal industry. Japan’s Government Pension Investment Fund alone holds bonds and shares in value of US$ 30 billion in companies listed on the GCEL. The third largest group are UK investors, whose collective holdings in the coal industry amount to US$ 47 billion.

“While the UK government recently announced that it will end public financing for overseas fossil fuel projects in 2021, most UK institutional investors have not even begun to expel coal from their portfolios. Unless they do their homework soon, the UK-hosted COP 26 will become a big embarrassment for these institutions,” states Katrin Ganswindt.

The Biggest Lenders to the Coal Industry

Urgewald’s research identified 380 commercial banks that provided loans totaling US$ 316 billion to the coal industry over the past 2 years. The top 3 lenders are the Japanese banks Mizuho (US$ 22 billion), Sumitomo Mitsui Banking Corporation (US$ 21 billion) and Mitsubishi UFJ Financial Group (US$ 18 billion). The 4th and 5th largest lenders to the coal industry are Citigroup (US$ 14 billion) and Barclays (US$ 13 billion).

“The coal policies adopted by Japanese banks are among the weakest in the world. They only cover a small portion of banks’ lending and do not rule out corporate loans or underwriting for companies that are still building new coal plants in Japan, Vietnam, the Philippines and elsewhere. Japan’s banks must stop pouring fuel on the fire and finally adopt comprehensive coal exclusion policies,” says Eri Watanabe from 350.org Japan.

A regional breakdown of lenders from different countries shows that Japanese banks collectively provided US$ 75 billion in loans to the coal industry from October 2018 to October 2020. Commercial banks from Japanese banks alone accounted for 24% of total lending to companies on the Global Coal Exit List over the past two years. In total, Asian banks accounted for 39% of total lending.

The Biggest Underwriters of the Coal Industry

Over the same time period, 427 commercial banks channeled over US$ 810 billion to companies on the Global Coal Exit List through underwriting. The world’s top 5 underwriters are all Chinese financial institutions.

ICBC (Industrial and Commercial Bank of China), the world’s biggest bank, is the top underwriter, with almost US$ 37 billion, and also figures in the top 30 list of lenders, with US$ 3 billion. ICBC’s record on coal financing is one of the worst among the largest banks in the world, and they are involved in controversial coal projects all over the globe, such as the Sengwa power station in Zimbabwe, Hunutlu power station in Turkey, Bengkulu Coal Power in Indonesia and many more.

“Facing the prospect of a global recession, investment in coal power infrastructure will become even riskier for borrowing countries and lenders. While the world is embracing the benefits of clean and affordable renewable energy, coal projects supported will lock recipient countries into dirty, dangerous and expensive fossil fuel infrastructure that is outdated. Instead, renewable energy investments can be a major force in economic recovery, generating decent returns on investment while boosting employment opportunities. It’s time for ICBC to correctly assess the risks implicated in their investments and stop financing coal projects,” says Yossi Cadan, Global Finance Campaign Manager at 350.org.

While Chinese banks account for less than 6% of total lending to the coal industry, they account for 58% of underwriting. Through their underwriting, Chinese banks channeled US$ 467 billion to the coal industry over the past two years. Next in line are US banks (US$ 105 billion), Japanese banks (US$ 59 billion), Indian banks (US$ 36 billion) and UK banks (US$ 35 billion). Together, banks from these 5 countries account for 87% of total underwriting for the coal industry, with China, Japan and India accounting for 70%.

Commercial Banks’ Support for the Coal Industry has Increased since Paris

The research also examined the development of banks’ lending and underwriting for the coal industry since January 2016. While direct lending for coal companies spiked in 2017, subsequent years show a downward trend in lending volumes. Underwriting of coal industry shares and bonds, however, has grown steadily since 2016. The alarming result of this analysis is that commercial banks are channeling more money to the coal industry than in 2016, the year after the Paris Climate Agreement was signed.

In 2016, banks provided US$ 491 billion through lending and underwriting to companies listed on the GCEL. By 2019, this amount had grown to US$ 543 billion, an increase of over 11%.

What needs to be done?

Ending the era of coal means ending the era of coal finance and investment. But the time to accomplish this task is quickly running out.

“While coal demand is falling in the United States and Europe, coal use is growing in Asia. Japan and China have both set lofty net-zero goals and they must meet them through a managed and determined phase out of fossil fuels. Banks in Japan and China must support their countries’ climate goals by withdrawing coal investments not just within their country but also abroad as that is where the vast majority of their investments are directed. This is the only way to prevent an unmitigated climate disaster that will affect communities in Asia and globally. I write this as another typhoon bears down on the Philippines, where I live. The climate disaster is now, it is not in the net-zero future,” says Chuck Baclagon, 350 Asia Finance Campaigner.

“What we need are comprehensive, immediate coal exit policies. Insurers such as AXA, banks like Crédit Mutuel, UniCredit and Desjardins or asset managers like Ostrum have already shown what must be done by excluding most of the companies on the Global Coal Exit List from their portfolios. Now is the time for the finance industry to act. A speedy exit from coal finance and investment is not only do-able and desirable, it is a question of survival,” says Yann Louvel, policy analyst for the NGO Reclaim Finance.

###

NOTES TO EDITORS

- The Global Coal Exit List (GCEL) is a comprehensive database of companies operating along the thermal coal value chain. It is produced annually by Urgewald and can be viewed at: www.coalexit.org

- The research was carried out by Profundo, a not-for-profit research company based in the Netherlands. Profundo used several financial databases including Bloomberg, Refinitiv Eikon and IJGlobal to compile the data for this project. These databases, however, only report syndicated loans, i.e. loans, which are provided by a group of banks to an individual company. These financial databases do not report bilateral loans, where a company borrows money from only one bank, rather than from a group of lenders. A significant portion of commercial banks’ lending, namely all bilateral loans to companies featured on the GCEL, is therefore not captured by our data.

- The data also has limitations on the investor side as many pension funds and insurers do not report on their holdings. While shareholding data is generally more complete, our research probably captures less than 1/3 of the bonds institutional investors hold in coal companies. It is therefore likely that the numbers for commercial banks’ lending to the coal industry and institutional investors’ bond holdings in the coal industry are significantly higher than our research shows.

Contacts:

Jacey Bingler, Urgewald, +49 175 5217571, [email protected]

Angus Satow, Reclaim Finance, +44 7847754046, [email protected]

Nathalia Clark, 350.org, +55 61 991371229, [email protected]

Annex: Top 30 Rankings

| Top 30 Lenders (Oct 2018 – Oct 2020, US$ mln) | |||

| Bank | Country | Loans | |

| 1 | Mizuho Financial | Japan | 22,244 |

| 2 | SMBC Group | Japan | 21,222 |

| 3 | Mitsubishi UFJ Financial | Japan | 17,929 |

| 4 | Citigroup | United States | 13,508 |

| 5 | Barclays | United Kingdom | 13,396 |

| 6 | Bank of China | China | 8,767 |

| 7 | Bank of America | United States | 8,471 |

| 8 | JPMorgan Chase | United States | 7,761 |

| 9 | BNP Paribas | France | 7,421 |

| 10 | Wells Fargo | United States | 6,266 |

| 11 | US Bancorp | United States | 5,365 |

| 12 | Royal Bank of Canada | Canada | 5,152 |

| 13 | Commerzbank | Germany | 5,061 |

| 14 | Crédit Agricole | France | 4,776 |

| 15 | Toronto-Dominion Bank | Canada | 4,418 |

| 16 | Société Générale | France | 4,240 |

| 17 | UniCredit | Italy | 4,110 |

| 18 | Sumitomo Mitsui Trust | Japan | 4,105 |

| 19 | Credit Suisse | Switzerland | 4,024 |

| 20 | ING Group | Netherlands | 3,882 |

| 21 | Scotiabank | Canada | 3,812 |

| 22 | HSBC | United Kingdom | 3,594 |

| 23 | Santander | Spain | 3,581 |

| 24 | State Bank of India | India | 3,566 |

| 25 | PNC Financial Services | United States | 3,337 |

| 26 | Norinchukin Bank | Japan | 3,139 |

| 27 | KeyCorp | United States | 3,090 |

| 28 | Industrial and Commercial Bank of China | China | 3,009 |

| 29 | BMO Financial Group | Canada | 2,977 |

| 30 | Goldman Sachs | United States | 2,971 |

| TOTAL | 205,191 | ||

| Top 30 Underwriters (Oct 2018 – Oct 2020, US$ mln) | |||

| Bank | Country | Underwriting | |

| 1 | Industrial and Commercial Bank of China | China | 36,993 |

| 2 | China International Trust and Investment Corp. | China | 31,648 |

| 3 | Shanghai Pudong Development Bank | China | 27,778 |

| 4 | Bank of China | China | 24,263 |

| 5 | China Everbright Group | China | 23,764 |

| 6 | Ping An Insurance Group | China | 23,392 |

| 7 | Agricultural Bank of China | China | 22,787 |

| 8 | China Construction Bank | China | 22,488 |

| 9 | Industrial Bank Company | China | 20,931 |

| 10 | China Merchants Group | China | 20,780 |

| 11 | Citigroup | United States | 19,619 |

| 12 | JPMorgan Chase | United States | 18,588 |

| 13 | Mitsubishi UFJ Financial | Japan | 18,128 |

| 14 | Mizuho Financial | Japan | 17,254 |

| 15 | Bank of America | United States | 16,387 |

| 16 | CSC Financial | China | 15,686 |

| 17 | Bank of Communications | China | 14,907 |

| 18 | Barclays | United Kingdom | 14,487 |

| 19 | Haitong Securities | China | 14,409 |

| 20 | Bank of Ningbo | China | 13,787 |

| 21 | China Minsheng Banking | China | 13,505 |

| 22 | HSBC | United Kingdom | 11,597 |

| 23 | SMBC Group | Japan | 10,756 |

| 24 | BNP Paribas | France | 10,553 |

| 25 | Hua Xia Bank | China | 9,899 |

| 26 | China Development Bank | China | 9,814 |

| 27 | Guotai Junan Securities | China | 9,327 |

| 28 | Goldman Sachs | United States | 9,125 |

| 29 | Morgan Stanley | United States | 8,796 |

| 30 | Bank of Shanghai | China | 8,316 |

| TOTAL | 519,765 | ||

| Top 30 Investors (2021 January or most recent filing date, US$ mln) | |||||

| Investor | Country | Bonds | Shares | Total | |

| 1 | Vanguard | United States | 11,840 | 74,012 | 85,852 |

| 2 | BlackRock | United States | 4,692 | 79,663 | 84,355 |

| 3 | Capital Group | United States | 2,021 | 36,330 | 38,351 |

| 4 | State Street | United States | 1,366 | 31,138 | 32,505 |

| 5 | Government Pension Investment Fund (GPIF) | Japan | 3,003 | 26,080 | 29,083 |

| 6 | T. Rowe Price | United States | 1,099 | 14,337 | 15,436 |

| 7 | Fidelity Investments | United States | 3,679 | 11,179 | 14,857 |

| 8 | Government Pension Fund Global | Norway | 2,308 | 12,264 | 14,572 |

| 9 | JPMorgan Chase | United States | 2,351 | 11,881 | 14,232 |

| 10 | TIAA | United States | 6,877 | 6,952 | 13,829 |

| 11 | National Pension Service | South Korea | 7,809 | 3,614 | 11,423 |

| 12 | Sumitomo Mitsui Trust | Japan | 7 | 10,596 | 10,603 |

| 13 | Geode Capital Holdings | United States | 10,394 | 10,394 | |

| 14 | Sun Life Financial | Canada | 1,655 | 8,735 | 10,391 |

| 15 | State Farm | United States | 4,855 | 4,023 | 8,877 |

| 16 | Franklin Resources | United States | 319 | 8,314 | 8,633 |

| 17 | Wells Fargo | United States | 537 | 7,832 | 8,368 |

| 18 | Nomura | Japan | 393 | 7,966 | 8,359 |

| 19 | Mitsubishi UFJ Financial | Japan | 88 | 8,164 | 8,253 |

| 20 | Allianz | Germany | 6,360 | 1,632 | 7,992 |

| 21 | California Public Employees’ Retirement System (CalPERS) | United States | 1,684 | 6,306 | 7,989 |

| 22 | Northern Trust | United States | 50 | 7,845 | 7,895 |

| 23 | Prudential Financial (US) | United States | 4,907 | 2,892 | 7,799 |

| 24 | Invesco | United States | 1,073 | 6,695 | 7,768 |

| 25 | Bank of New York Mellon | United States | 439 | 7,261 | 7,701 |

| 26 | Wellington Management | United States | 1,951 | 5,629 | 7,580 |

| 27 | Berkshire Hathaway | United States | 551 | 6,751 | 7,302 |

| 28 | Life Insurance Corporation of India | India | 7,160 | 7,160 | |

| 29 | Legal & General | United Kingdom | 330 | 6,825 | 7,155 |

| 30 | AFP Capital | Chile | 6,866 | 280 | 7,147 |

| TOTAL | 79,110 | 432,749 | 511,859 | ||