On August 25, 2014, Bloomberg New Energy Finance released a white paper acknowledging and analyzing fossil fuel divestment in the world of finance. Fossil Free Campaigner Jay Carmona and Cat Jaffee Digital Divestment Campaigner share their thoughts regarding the white paper and what it means for the Fossil Free divestment movement.

From Jay Carmona, Fossil Free Community Divestment Manager at 350.org:

This white paper is significant for four reasons.

1. It’s timely. This is the latest from the financial community about divestment, and it is and will be something that campaigners can point to that is relevant right now. Trends are important in the finance world and being able to point to this document will be significant support to any argument for divestment.

2. It’s from Bloomberg. Bloomberg is a financial institution with major name recognition, and that’s a big deal. If Bloomberg is looking at divestment, chances are most other people are too, and if they’re not, they’re not up to date.

3. It discusses how to do divestment in financial terms. Bloomberg is not saying that divestment is impossible, they’re saying it is a challenge, and they address some of the issues that divestment brings up from a practical standpoint. This is a win for our movement because it demonstrates how major players are realistically thinking through divestment as a strategy.

4. It emphasizes coal divestment. This recommendation is important for us to know so that we can put extra pressure on making sure institutions are seeing coal divestment as a first step down a longer path toward full divestment. We can’t let institutions take the path of least-resistance (to quote Utah Phillips, “the path of least resistance is what makes the river crooked”).

From Cat Jaffee, Digital Divestment Campaigner at 350.org:

This white paper is significant for four reasons.

1. It confirms viability. Bloomberg reports that ex-fossil fuel portfolios have had the same level of performance as portfolios that include oil, gas, and coal producers and companies with high carbon reserves.

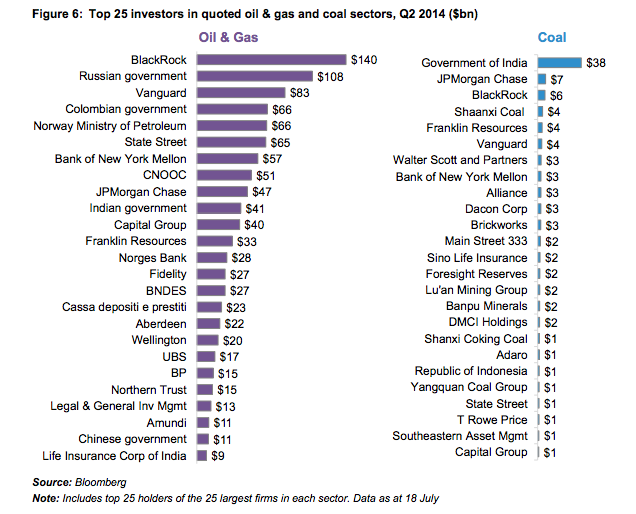

2. It targets the big boys. Bloomberg includes clear graphics and data that highlight that the largest 25 holders of the largest 25 oil and gas firms control more than $1 trillion worth of shares. It acknowledges that a large-scale divestment movement will have to go after firms that have $1 trillion of assets under their management such as BlackRock, Vanguard, State Street, and Capital Group.

3. It predicts reinvestment growth. Bloomberg predicts that reinvestment opportunities are growing, forecasting that there will be $40 billion in issuance (of Green Bonds) this year, which is the equivalent of the number of Green Bonds issues in the past two decades combined.

4. It suggests that divestment can make investing less risky. Bloomberg acknowledges financial divestment rationale saying it’s a “potential value preservation strategy for some institutional investors”

Perhaps, the most moving piece of the White Paper is that it is poetic and it does something that finance could do well to include a bit more of: acknowledge that investment is “fundamentally human.”

“For all of the tools available for financial analysis, institutional investment remains fundamentally human. People choose portfolios, and people assess risk. Clear-headed investors may look at fossil fuel equities and weight them not just against historical return and yield, but also future prospects given new technologies, consumption patterns, regulations, and finally, public perception.”

To read the highlights from the White Paper, see below. To access the full report in PDF form, please click on here.

FOSSIL FUEL DIVESTMENT: A $5 TRILLION CHALLENGE

Highlights from the executive summary

Oil & gas and coal companies form one of the world’s largest asset classes, worth nearly $5trn at current stock market values. In the past two years, dozens of public and private institutions have announced plans to divest fossil fuels from their portfolios – a movement one executive described as “one of the fastest-moving debates I think I’ve seen in my 30 years in markets”.

Fossil fuels are investor favourites for a reason. Few sectors offer the scale, liquidity, growth, and yield of these century-old businesses vital to today’s economy. This White Paper explores the motivations behind fossil fuel divestment, the scale of existing fossil fuel investments, and potential alternatives for investment re-allocated from oil, gas, and coal stocks.

- “Fossil fuel divestment” is a concept that can reflect various societal or practical considerations. Environmental concerns, moral and ethical stances, concerns about asset stranding, and portfolio diversification are all potential rationales.

- Fossil fuel investment meets numerous institutional investor imperatives. Fossil fuels offer four attributes (overall scale, liquidity, value growth, and dividend yield), a more complete investment package than that provided by most other sectors.

- Fossil fuels are an enormous asset class. The current value of the 1,469 listed oil and gas firms is $4.65trn; 275 coal firms are worth $233bn. ExxonMobil, the largest oil and gas firm, has a market cap of $425bn.

- The world’s largest investors – and many governments – are the key shareholders in fossil fuel companies. BlackRock, the largest investor in oil and gas equities, controls $140bn via just its largest 25 holdings. Governments of many countries, including China, Russia, and India, are strategic investors in public companies as well.

- Divesting from fossil fuels does not equate to investing in renewables. Clean energy will attract $5.5trn in investment between now and 2030, according to Bloomberg New Energy Finance, but not every dollar will be suitable for every institution. Projects, public equities, YieldCos and green bonds offer stability, growth, and yield, but not all in one package.

- Other major sectors offer some of the attributes of oil and gas companies, but not all of them. Information technology is significantly larger than oil & gas as a sector – $7trn – but pays low dividends as a proportion of post-tax profits. Real estate investment trusts are only $1.4trn in total market cap, but currently have average dividend yields of more than 4%.

- Significant divestment from coal would be much easier than significant divestment from oil and gas. Listed coal companies are small enough in aggregate that investors could divest and re-invest without unbalancing portfolios. Oil and gas companies are too large, and too widely held, for divestment to be easy or fast.

- A robust architecture for fossil fuel divestment will require alternative investment structures or asset classes, not just “alternative energy”. In order to attract trillions of re-invested institutional dollars, clean energy will need a vast expansion of its YieldCo and green bond structures, or indeed, new, as-yet-unbuilt instruments.